Are you able to make objective factual decisions based on the numbers that you see in your business?

Many business owners only look at their financial statements just once a year. They go straight to the bottom line to see whether they made a profit or not. But your financial statements contain a wealth of information, and with the right tools, you can quickly determine how ‘healthy’ your business is.

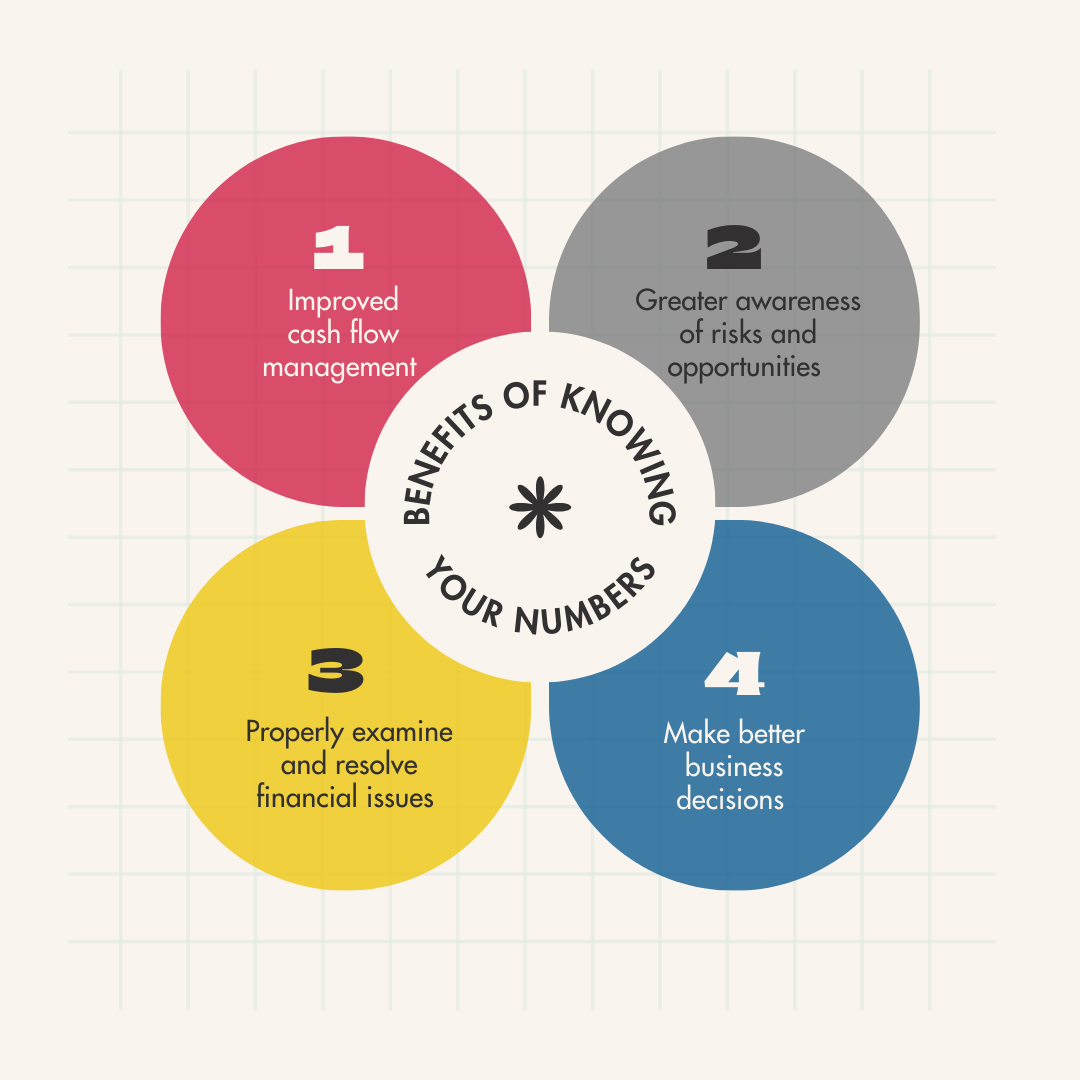

Knowing your numbers around cash flow, margins, profit and loss and break even points, will give you back tighter control of your financials. It will help you manage your cashflow better to shorten the cash gap and it will give you the knowledge to make informed decisions about your business.

If you smartly examine the numbers within your business, you will be able to interpret these figures for increased sales, rapid growth and improved profitability.

But one of the key reasons businesses struggle is because they fail to apply the numbers objectively, and knowledgeably, in the decision making process.

So, what are some the financial numbers you should be paying closer attention to?

We explore this and more in our latest handy guide – Small Finance Tips for Small Business Owners. And if you still want to find out more, why not book a free business coaching session and we can help you make sense of it all.