Top strategies for a robust cash flow

In our previous blog, Instantly Improve your Cash Flow despite Record Inflation, we discussed cash flow budgeting and how owners of small and medium-sized businesses could rapidly improve their cash flow just by making a few simple changes in four areas of their business.

In this second instalment on cash flow management, we take a look at closing any cash flow gaps that may be holding your business back from growth.

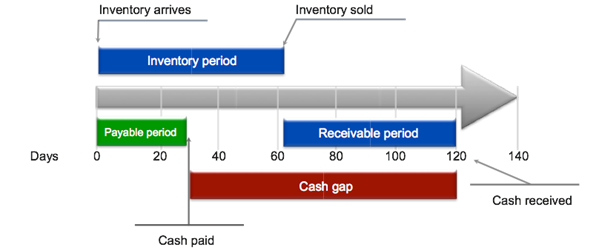

Cash flow gaps – periods when cash outflows exceed cash inflows when combined with your cash reserves.

Just as a cash flow budget offers insight into the money coming into and out of your business on a weekly or monthly basis, it can also predict your business’s cash flow gaps, those times when there is not enough money coming in to cover the money going out.

If predicted early, you can proactively take cash flow management steps to ensure that the gaps are closed or at least narrowed when the time comes.

Closing the Cash Gap

A healthy cash flow is essential to any successful business. It’s crucial you can pay your creditors, suppliers and employees if you want to remain in operation. Equally important is invoicing your customers timeously and managing accounts receivables closely.

I recall working with a client recently who was doing very well in terms of volume of business yet was still concerned about covering salaries at the end of each month. Diving into the cash flow budget and forecast, it quickly became apparent that the generous payment terms offered to customers were hindering their ability to bring in enough cash at the right time to match outgoing expenses.

Solution – reduce the payments terms from 30 days to 14 days.

Now obviously, the implementation of this change didn’t happen overnight. It did involve discussions with existing customers and a rollout to new customers when onboarded, but the cash flow pressure at month-end was soon significantly eased.

It also meant my client had to adjust their mindset about how to approach their business. Yes, 30 days may be the most typical payment term, but it’s not the only one. It’s all too easy for small business owners to adopt business practices they consider as ‘the standard’ and therefore correct. If successful Company XYZ does that, it must work, right?

Wrong. Your business is its own ecosystem that should be supported by relevant practices that contribute to sustainable business growth. Particularly in the early years of trading when cash flow can make or break the company.

Other Clever Cash Gap strategies

To effectively manage your business’s cash flow, you must first analyse the components that affect the timing of your cash inflows and cash outflows. More on this later in the blog.

A good analysis of these components will point out problem areas that lead to cash flow gaps for your business. Narrowing, or even closing, cash flow gaps is the key to cash flow management.

Credit: http://www.canzioandpartners.com/

Now you know where the gaps are, what can you do about them? Well, here are some handy strategies to shorten the cash gaps in your business:

- Require partial or full payment on contract to be paid upfront.

- Finish projects as quickly as feasible so that they can be billed/invoiced.

- Bill/invoice immediately on completion of the job. Make sure your accounts team understand the knock-on effect of late invoicing.

- Systemise billing/invoicing process. Support your team with proper training to use the system.

- Complete the billing/invoicing process on a weekly basis, rather than waiting for bulk processing at month-end.

- Send multiple bills/invoices escalating the demand for payment at 14, 30, 45 days.

- Offer 1 to 2% discount for early paying of invoices.

- Add and collect interest on overdue accounts. Stipulate this clearly on your invoices and statements.

- If resources are an issue, outsource the entire billing/invoicing process to speed up receivables, etc.

- Reduce inventory by using low inventory trigger points for restocking.

- Buy inventory on consignment and pay when sold.

- Negotiate longer terms from vendors.

More on analysing cash flow

Managing Accounts Receivables

Accounts receivables are those sales that you haven’t yet been paid for and are usually the most significant source of cash inflows. Worse case, unpaid accounts can leave the business without any cash to cover expenses. More commonly though, delays in recovering these accounts cause cash shortages, making it harder for the business to meet cash outflows when they fall due.

Several analysis tools will help you understand the impact accounts receivables is having on your cash flow:

- Average collection period measurement – this refers to the average number of days it takes to collect accounts receivable. In basic terms, the days between when the sale happens and when payment is received. The shorter this is, the better for cash flow purposes.

- Accounts receivable to sales ratio – this measures how much of the overall sales are made on credit, as a percentage. The higher the percentage, the more likely the organisation is to run into cash liquidity problems.

- Accounts receivable ageing schedule – The ageing schedule can be used to identify the customers that are extending the time it takes to collect your accounts receivable.* This insight will allow you to tighten collection controls for those customers who habitually push beyond their given credit terms.

Managing Accounts Payable

As with an accounts receivable schedule, an accounts payable schedule will help you determine how well you are managing your cash outflows. It provides visibility into when outgoing payments fall due for the current period and indicates how much cash will be required to cover those bills during the same period. Identifying problems early enough can prevent any major trade credit issues and will improve overall cash flow management.

By now, it’s pretty clear just how important a robust cash flow is for any successful business. In fact, it’s often the starting point for any financial growth strategy discussions with my clients. Once cash flow inputs start to exceed outflows, then expansion plans can really begin to take off!

If you are keen to know more about managing your cash flow, contact us for a chat.

Source:

* https://www.wolterskluwer.com/en/expert-insights/accounts-receivable-aging-schedule-illustrated